- #Most common monthly expenses how to

- #Most common monthly expenses software

- #Most common monthly expenses free

As a result, it can be helpful to learn more about personal finance. Lacking knowledge-Not everyone is expected to be an expert on personal finance, and it is very possible that misinformation or lack of awareness can lead to people living outside of their means.However, if borrowers are unable to pay back the borrowed money on time, they will probably find themselves in a sticky financial situation. Overly relying on credit-This borrowed money allows people to live beyond their means temporarily.Trying too hard to keep up with the Joneses-In consumerist societies, conspicuous consumption, defined as the spending of money on, and the acquisition of, luxury goods and services to publicly display economic power, is common.Spending more than their income allows-The biggest financial blunder people can make is simply spending more than they earn, which over the long-run snowballs into more and more debt.The reason why people are not able to adhere to the principle is generally due to reasons such as:

As simple as it may seem, many struggle to implement it successfully in their lives, as the statistic that eight out of ten Americans are in debt, shows. Millennia-old religious teachings, countless online resources, and thousands of financial advisors over time have echoed the principle of living within your means. Successful budgeting usually involves having a detailed personal budget and adhering to it.

#Most common monthly expenses how to

How to Budgetīudgeting can generally be summed up by two things: living within your means and planning for the future. They all have their pros and cons, but the one that works best is the one that budgeteers will bother sticking with as best as they can.

#Most common monthly expenses software

Modern technology has paved the way for many different budgeting software and apps.

#Most common monthly expenses free

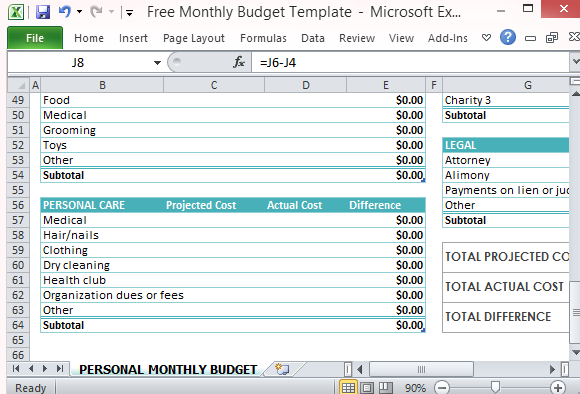

While some people may prefer our budget calculator or our free budget template, others may prefer different methods. There are many different reasons why people create budgets, and even more ways to go about doing so. Generally, budgets are created to reach certain financial goals, such as paying off several credit cards, reaching a certain savings goal, or getting income and expenses back on track. Related Debt Ratio Calculator | Credit Card Calculator | College Cost CalculatorĪ budget is an estimate and planning of income and expenditure, and commonly refers to a methodical plan to spend money a certain way. Including tickets, gym membership, etc. savings, CD, house or major purchase, etc. copay, uncovered doctor visit or drugs, etc. laundry, barber, beauty, alcohol, tobacco, etc. the recurring part to payback balance only electricity, gas, water, phone, cable, heating. repair, landscape, cleaning, furniture, appliance. home owner, renters, home warranty, etc. gift, alimony, child support, tax return. interest, capital gain, dividend, rental income.

0 kommentar(er)

0 kommentar(er)